What to Know About Managing Lease Term Changes in JD Edwards EnterpriseOne

-

Posted by Quest Editor

- Last updated 9/16/24

- Share

The International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) have issued two new standards requiring lessees of property and non-property assets to account for these leased assets and the liability associated with them on their balance sheet. To help customers manage lease term changes in EnterpriseOne, the JD Edwards team created an informative video about how to process lease term changes impacting the amortization schedules and journal entries associated with balance sheet lessee accounting process.

Before proceeding, let’s take a look at a high-level overview of the Balance Sheet Lessee Accounting business process:

This process updates monthly financial statements for your leased assets.

The JD Edwards video below gives an overview of:

- How to make changes to your leases

- How to terminate the lease early

- How to ensure that all proper updates are made to amortization schedules

- How to ensure that all journal entries for the remeasurement or termination are completed

- How to perform mass updates of leases

Roles in the Balance Sheet Lessee Accounting Process

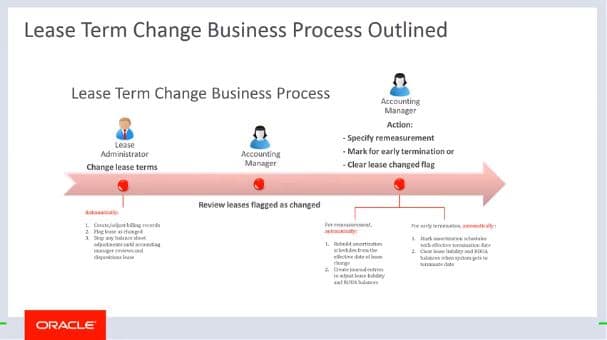

If you are a Lease Administrator, you can use the EnterpriseOne system to make lease term changes and flag the lease as changed.

The Accounting Manager will be notified of the changes and can subsequently review and process the changes further for remeasurement, early termination, or to clear the lease changed flag if the changes are not required.

Lease Term Changes

When a lessee lease reaches the lease liability status of 20 amortization schedules created, there may be changes in the lease terms or billing records. These changes are referred to as lease term changes. Lease term changes may be due to:

- Lease extension

- Early lease termination

- Changes in the amount associated with the lease

Any lease term changes impacting the lease information can be made using the Lease Information program within JD Edwards EnterpriseOne. The only lease term changes that can be made to the Lease Master are the borrowing rate and the ROU end date field. To enter these lease term changes, access the Lease Master Information program from the Tenant and Lease Information menu.

In the Lease Master Revisions form, you can change the borrowing rate and the ROU end date directly in the detail line grid. Alternatively, you can select the lease line and use the Change Lease Terms row menu option to change the fields as well.

Entering Lease Term Changes in Billing Records

If you are a Lease Administrator, you can make lease term changes impacting the billing records for the lease using the Recurring Billing Information program in JD Edwards EnterpriseOne. The billing record changes include changes in the amounts or dates associated with the leased assets, which impact the amortization schedules and journal entries associated with the Balance Sheet Lessee Accounting process.

To enter lease term changes in your Recurring Billing records, access the Recurring Billing Revisions form, select a billing record, and select “Change Lease Terms” from the row menu. This option is only available if the selected row has existing amortization schedules and the Effect on Lease Liability field is set to “yes.” When you use this option, you select one billing record and make your changes, and the system will automatically adjust billing records.

When selecting “Change Lease Terms” from the row menu, the system displays the Change Lease Terms window only for rows having the same lease version as the default lease version in the header. The Change Lease Terms window includes header information for the lease line and enables you to make changes to the Term Change As Of Date, Gross Amount, Term Change End Date, and Effect on Lease Liability fields.

After you enter your changes and click “OK,” the system returns to the Recurring Billing Revisions form and enters an ending date in all existing billing records that is one date prior to the date that you entered in the Term Change As Of Date field. The system then creates new rules for all necessary records using the new start and end dates that you entered. If you did not enter a new end date, the end date of the selected record is used as the end date on the new records. You can make any additional changes directly in the grid. Save your changes by ensuring that you click “OK” in both the Change Lease Terms window and the Recurring Billing Revisions form.

Manually Entering Billing Records

Alternatively, you can manually enter changes to the lease terms in the detail area of the Recurring Billing Revisions form. You would have to also manually create any new lines that are needed. It’s important to note that the ability to edit a grid column depends on the existing editing constraints and the lease term changes recurring billing constraints, regardless of the status set in the Effect on Lease Liability field.

After you, as the Lease Administrator, make lease term changes to a lease and save your changes in the system, the system updates the Recalculated Lease Liability field on the lease to a value of either 1 or 2. This indicates either to measure, terminate, or remeasure. The Accounting Manager is then notified that the change needs his or her attention.

Lease Remeasurement Amortization Schedules

As the Accounting Manager you can access the Amortization Schedules form and review whether to remeasure the amortization schedules of the lease, flag the lease for early termination, or clear the recalculate flag.

To review the leases that are flagged for lease term changes, access the Work with Amortization Schedules form from the Balance Sheet Lessee Accounting Menu. Search for the leased asset that you want to process and verify that the Recalculate Lease Liability field contains a value of either 1 or 2.

If the value in the Lease Liability field is set to 1, you must run the remeasurement process on the lease to continue with Balance Sheet Lessee Accounting processing. This option is available when you make any change to a leased asset that impacts the existing amortization schedules. Select the row that you want to remeasure and select “Remeasure” from the row menu. The system will run the remeasurement process and performs steps based on the Lease Liability Status of the asset.

If the status is 20 or 30, the system deletes the existing schedules, recreates new schedules using the updated lease terms, and resets the Recalculate Lease Liability field to 0. If the status is 40, the system updates the amounts in the amortization schedules starting in the next unprocessed month, creates a batch of remeasurement journal entries, and resets the Recalculate Lease Liability field to 0. You can now review, approve, and post your remeasurement journal entries.

Early Termination Process

Run the Early Termination process to end the lease earlier than planned, keep the original amortization schedules, and, if necessary, create termination journal entries at the end of the lease. This option is only available if the Recalculate Lease Liability field is set to 2.

To run the Early Termination process on a leased asset from the Balance Sheet Lessee Accounting menu, select “Amortization Schedules” on the Work with Amortization Schedules form. Search for the leased asset whose lease you want to terminate early, verify that the Recalculate Lease Liability field contains the value 2. Then, select the row that you want to terminate and select “Terminate Early” from the row menu.

The system runs the Early Termination process, which includes:

- Creating a batch of termination journal entries

- Updating the amortization schedule with the journal batch information

- Identifying the termination period

- Resetting the Recalculate Lease Liability field to 0

You can now review, approve, and post your termination journal entries. During the month of early termination, journal entries are created to clear out the Lease Liability and ROU account balances.

Mass Update of Assets in a Lease

You can use the Global Update program to update recurring billing records for one or more leased assets in a particular lease. If you have a lease with many leased assets, the Mass Update program helps apply changes across all assets on a lease. Before running the Recurring Billing Global Selection program, set the processing options associated with the Global Update process that determine whether the lessee recurring billing update process is available for use for recurring billing records associated with leased assets for which amortization schedules exist.