What’s happening with PeopleSoft Payroll?

-

Posted by Quest Customer Learning Team

- Last updated 8/15/23

- Share

Anne Leung, Senior Director for Oracle PeopleSoft HCM Applications Development and Payroll Strategy, recently presented the updated PeopleSoft Payroll Update and Roadmap at RECONNECT Live! at BLUEPRINT 4D. Read through this post for a summary of her presentation, view the session replay or review the presentation deck.

Enhancement Updates

For PeopleSoft Payroll, there are three images per year and four tax updates per year.

The next urgent legislative update will be delivered November 24, 2023 through PeopleSoft Release Patchset (PRP). It is the year-end tax update. We will continue to have postings after that date.

Below is a diagram of the enhancements of 2022–2023 payroll for North America:

As for PeopleSoft Payroll Insights: Global Payroll and Payroll for North America, there are three categories of visualization dashboards: Cost, Operations, and Trends.

Two Cost dashboards are available for North America—one for the U.S. and one for Canada.

Operations dashboards are for administrators. These give you visualizations of your audits. What are you running? What’s outstanding? What phases are you in? You can see retro volume, along with the causes of retro triggers.

Trends is a 6-month lookback of your data and payroll. You can change the date range if you’d like. You can do comparisons of earnings and drill down for more information.

Customers are loving Quick Calculation on Payroll for North America.

Quick Calc allows you to run a process for one employee. In the past, you had to run payroll for the entire population to see your results. With Quick Calc, you can run results and get an on-page link to the review paycheck at the push of a button. This is the same as your Review Paycheck if you were to navigate on the menu to Review Paycheck. If there are errors, you’ll get the error message right there. The idea is that you can see the results for one employee. Assuming it’s not your problem child-paycheck (everyone has one or two), you can see if the calculation is correct.

Quick Calc has been used by IT people, too, in testing. It’s well-loved and was developed as the result of an Idea Space suggestion. If you’ve been taking tax updates all along, then you have Quick Calc. *You may need the installation page that enables Quick Calc to make sure your user has access to this component.

PNA Direct Deposit was delivered in Image 44 as an Idea Space item. Most of these capabilities were added as a result of customer requests in Idea Space:

- Balance Account

- Remove Payment Check

- Optional Print

- Number of Accounts

- Restrict Account Removal

- Inactive Bank Accounts

- Override Print Options

These options are in an installation table for you to set up. Featured in Image 44, the following is available for customers in the U.S. and Canada.

W-2 and W-2c Tax Preparer Import File offers a better experience for employees when filing taxes. They will no longer need to type in their W-2 information in tax preparer software like Intuit TurboTax.

This feature is an integration with TurboTax. If you have used TurboTax, you can type in your company’s EIN number and another number in the system. It will load the employee for you.

The biggest customer concern in this area is security and PeopleSoft is working on this. It’s worth taking a look at if you’re not using a third party for your W-2s.

Import File – Creates a file that combines Federal, State, and Local W-2 data based on EFW2 format

Audit – Shows information being included in the import file, not part of the EFW2 file format and information excluded from file

Corrections – Creates a file that includes selected employees with corrections or all employees with corrections in the system for that Tax Year

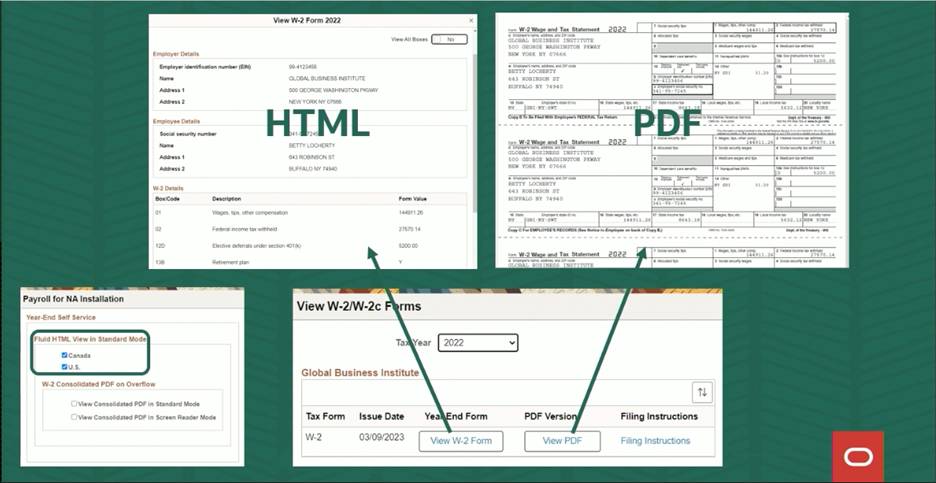

Another feature that was delivered a while ago is equal access to Fluid employee self-service year-end details for all users. Equal access allows employees access to Fluid HTML online year-end details pages that were previously available only to accessible users. The forms and slips that are available are:

- T4/T4A Slips (Canada)

- RL-1/RL-2 (Quebec)

- W-2/W-2c and Territories (U.S.)

A PDF version of Form W-2 is already accessible to be used with a screen reader with single page accessibility. In Image 46 or after applying the scheduled year-end PRP, employees will have access to an overflow PDF which allows viewing all pages in one file. Screen reader accessible overflow PDF pages are available for multiple states, localities, and more than 4 boxes for 12 to 14 for Form W-2. There is also an option to enable viewing all pages in one file without making the pages accessible.

A PDF version of Form W-2 is already accessible to be used with a screen reader with single page accessibility. In Image 46 or after applying the scheduled year-end PRP, employees will have access to an overflow PDF which allows viewing all pages in one file. Screen reader accessible overflow PDF pages are available for multiple states, localities, and more than 4 boxes for 12 to 14 for Form W-2. There is also an option to enable viewing all pages in one file without making the pages accessible.

Interested in connecting with other customers to dig into challenges, learn best practices or explore new innovations? Join the PeopleSoft Payroll for North America Special Interest Group or the PeopleSoft Global Payroll Special Interest Group. Bring your questions and find answers at our monthly online meet-ups. Membership is free – it’s a great way to meet other PeopleSoft customers!

Want to dive deep into the latest feature enhancements, roadmap updates and hot topics for PeopleSoft Payroll? Join us online for RECONNECT Dive Deep – Virtual!, October 23-26, 2023. Learn directly from the Oracle experts, hear what other customers are doing with their PeopleSoft systems and see the latest PeopleSoft features and innovations from innovative technology leaders. Bring the team and save with an unlimited access virtual corporate pass! Learn more.

Form 1042-S and Form 1099-R can be bulk printed in BI Publisher.

- Form 1099-R can be bulk printed using BI Publisher for 4 corner laser cut and 4 corner pressure seal.

- Form 1042-S can be bulk printed using BI Publisher for laser cut forms only.

- Order forms from vendors with a blank front and instructions on the back are used by PeopleSoft for W-2 BI Publisher printing.

Global Payroll and Absence Management users can now create Element Trace for specific employees and calendars with the following features:

- Payee Selection – Generate the Element Trace for Payee or List of Payees

- Select Calendars – Users can limit the Element Trace generation to only select Calendars for each Payee

- Element Trace Continues with Failed Process – Element Trace will generate even if the process fails

Legislation

2022 Payroll for North America Legislative Updates are listed below:

Program Funding Configuration configures rules to calculate employee and employer-funded U.S. legislation like Paid Family & Medical Leave (PFML) and Long-Term Care (LTC). Dynamic Configuration offers pages and reports that dynamically update when Program Funding Configuration is set up for a particular state. This includes:

- Employer Company State Tax Table

- Employee Tax Data

- Reports (Electronic reporting will still require new deliverables)

- General Ledger

There are several benefits to the Program Funding Configuration. It eliminates the need to make massive changes for COBOL, SQR, and online changes for new legislation. PeopleSoft delivers rules for new state legislation with defined requirements for all employees, customers can add or modify rules, and the same Tax Classes can be used for different rules (such as employees in Unions). The latter was delivered in Image 46: Tax Update 23-B.

Below are some of the PFML legislation that has been delivered or is schedule to be delivered:

- Colorado – Payroll deductions effective January 1, 2023 (Delivered PRP & Tax Update 22-E)

- Oregon – Payroll deductions effective January 1, 2023 (Delivered Tax Update 22-E)

- New Hampshire – Effective January 1, 2023 (PeopleSoft will not be delivering rules. Customers have used Program Funding Configuration to implement. Employers who choose to participate must contract for coverage with MetLife.)

- Maryland – Payroll deductions effective October 1, 2024

- Delaware – Payroll deductions effective January 1, 2025

Previously delivered Paid Family & Medical Leave or Long-Term Care will not be re-delivered in Program Funding Configuration.

2023 Payroll for North America Legislative Updates are listed below:

Here’s a comprehensive look at Global Payroll Updates:

What’s Coming

On the roadmap are several exciting updates for Payroll.

- In Canada, employees will be able to update their Federal TD1, TD1X, and TD1-IN through employee self-service.

- Payees will be able to view their Form 1042-S and Form 1099-R online.

- Payees who have been granted permissions roles will be able to view Form 1042-S and Form 1099-R online with Fluid self-service.

- Payees will have access to Accessible for All HTML online pages whether in standard or accessible mode. Screen readers will be able to read PDF Forms for payees.

- Payees will be able to grant consent online to not send paper versions of forms. Administrators can control consent.

More features on the Payroll for North America Roadmap are:

- U.S. Remote Worker Tax Enrollment and Distribution

- Fluid Paycheck Modeler

- Concurrent Process Actual Distributions

- Canadian TD1 Provinces Self-Service

- Accessible PDF T4/T4A and RL-1/RL-2

Global Payroll Roadmap

On the Global Payroll Roadmap, Peoplesoft will continue to work on:

- Export Payroll Results Register to a CSV file

- Bank and Net Distribution Notifications

- Element Trace Viewer

HCM Lockdown is a completely re-envisioned version of Payroll for North American (PNA) Component Lockdown. It has been enhanced based on Idea Space feedback and incorporates the following changes:

- Accessible for Payroll for North America, Global Payroll, and Absence Management process

- No longer needed to add PeopleCode manually for non-PNA pages to lockdown

- Define multiple roles and users together, plus exclude users from lockdown, too

- Ability to continue lockdown between processes

For a demo of HCM Lockdown, watch this video from 46:09 to 57:55.

Take Action

There are so many new features to PeopleSoft Payroll, and more are on the way—but you don’t have to leverage them all at once. Start with one. If you haven’t implemented Quick Calculation, we suggest starting there. It’s a favorite among users and incredibly easy to implement. If you already have Quick Calc, pick a new feature from the list below to begin experiencing the benefits of the latest updates from PeopleSoft Payroll.

Quest Oracle Community is where you learn. Ask questions, find answers, swap stories and connect to other PeopleSoft customers and product experts. Find out more.